In the Shadow of the Dragon (an Elephant emerges)

“So comes snow after fire, and even dragons have their endings.”

J.R.R. Tolkien, The Hobbit

In 2020, a journalist, Sebastian Strangio, published a book called In the Dragon’s Shadow: Southeast Asia in the Chinese Century. Strangio was drawing on years of on-the-ground work to tell his tale of Southeast Asia’s exposure to the waxing power of China. The book was timely—at that moment—and China’s rise to usurp the United States seemed all but inevitable, while the nations surrounding it seemed tethered to its economic and power politics.

Then, Covid-19 hit shortly before this book was released, changing supply chain dynamics and leading to a diversification push from countries like the United States away from China. This was strike one for China.

In addition to Covid-19 changes, China’s leadership has committed one policy blunder after another. Excessive lockdowns, popping a real estate bubble, going after the largest private enterprises, hiding unemployment data, saber rattling, deflation, and frightening foreign investors through erratic policy and arrests, are just a few of China’s many mistakes. The inevitable result is a violation of global and investor trust.

To make matters worse, leadership continues to say it will work to gain faith again, but then its internal actions contradict what it is saying. A recent example is an announced policy crackdown on video game companies–an action that makes the world think China dramatically shifted from one of the most open global economies to a complete nanny state where power trumps economics.

So today, after what have been mostly self-inflicted blunders, the world is asking an entirely different question than the one initiated by Strangio. What happens when you are in the shadow of the waning power of China?

New World

Emerging markets (EM) had a no good, rotten, bad year, and we had an even tougher year partially due to our tilt down the capitalization spectrum and to smaller countries but also due to the fact that we missed a few quality bargains.

One of the things we missed that fit our process was obvious quality companies at great valuations in Taiwan after large stock market corrections in 2021-2022, particularly in the technology heavy sectors that dominate Taiwan.

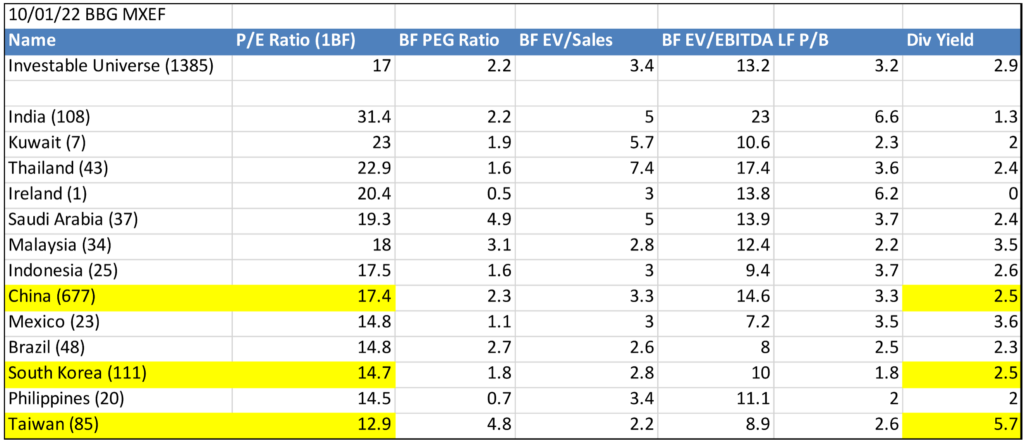

At the approximate abyss of the market in October of 2022 (also coincident with when Warren Buffet saw value in Taiwan and bought Taiwan Semiconductor in the third quarter of 2022), Taiwan was a bargain.

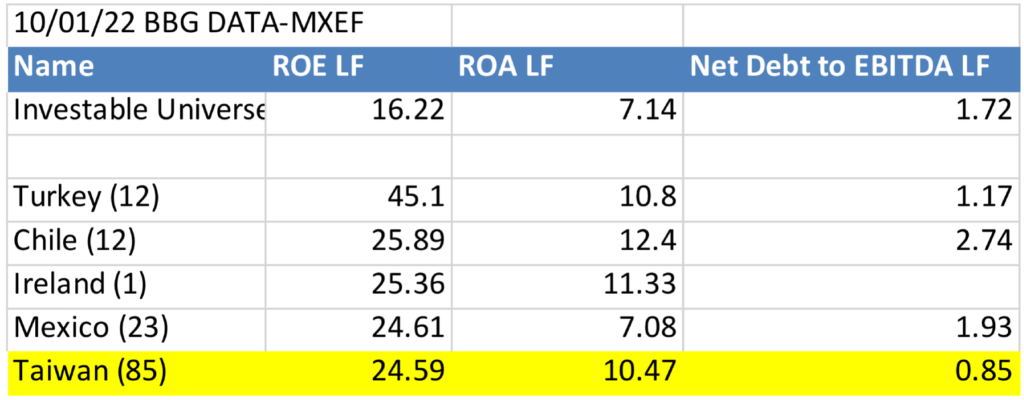

On the surface, Taiwan was also quality. We look for high ROE (Return on Equity), high ROA (Return on Assets), and good balance sheets, as financial indicators of sustainable future results (quality), and the data below from Bloomberg for the same period as above shows that Taiwan was accretive to the index on all metrics—Taiwan had higher quality companies.

Our fear and reason for not making Taiwan a bigger weight in our portfolio was two-fold.

First, we were worried about Taiwan being tethered to China’s geographical aspirations—a reason for which Warren Buffett eventually sold Taiwan Semiconductor.

Second, we thought hardware technology and technology in general had benefitted from all of us sitting home buying televisions, tablets, cars, computers, phones, and anything with a chip with our stimulus money during Covid-19. We thought the above ROE and ROA numbers were peak numbers (as good as it gets) and the quality would fall. In our vernacular, we were worried about momentum.

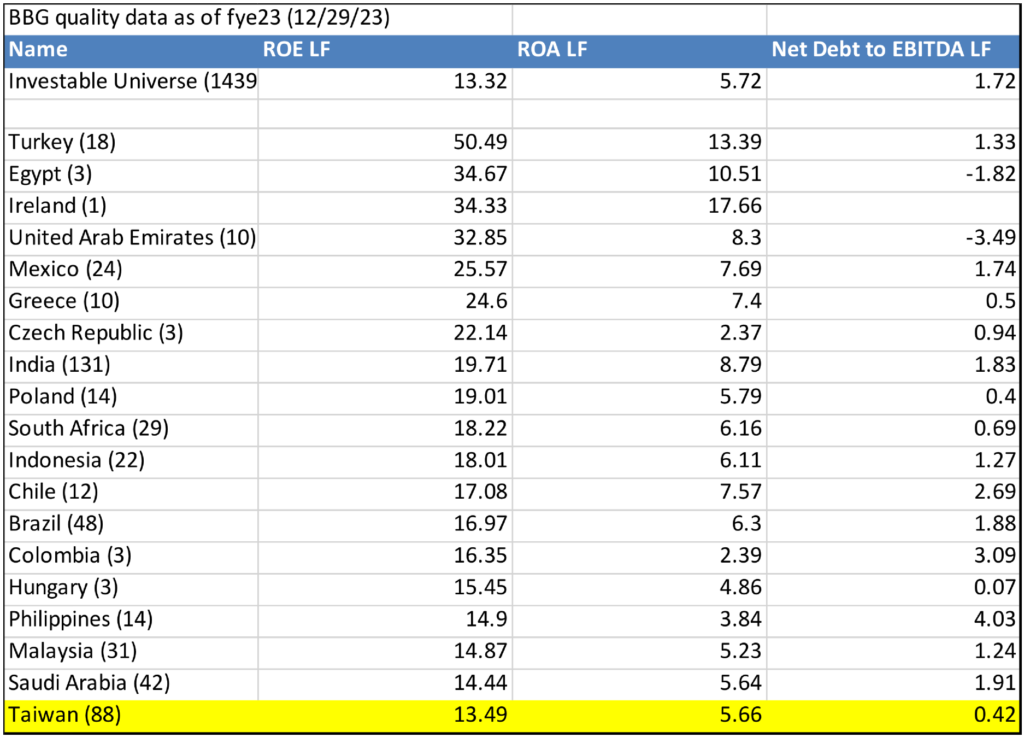

And we were right, the quality did fall in aggregate Taiwan, as reflected in the index to year-end 2023. There is an ongoing inventory correction in technology (“stuff”) that continues to weigh on fundamental results.

The above is in descending order of ROE. Taiwan has fallen down the ranks, as consumers and businesses curtail spending.

But the market did not care.

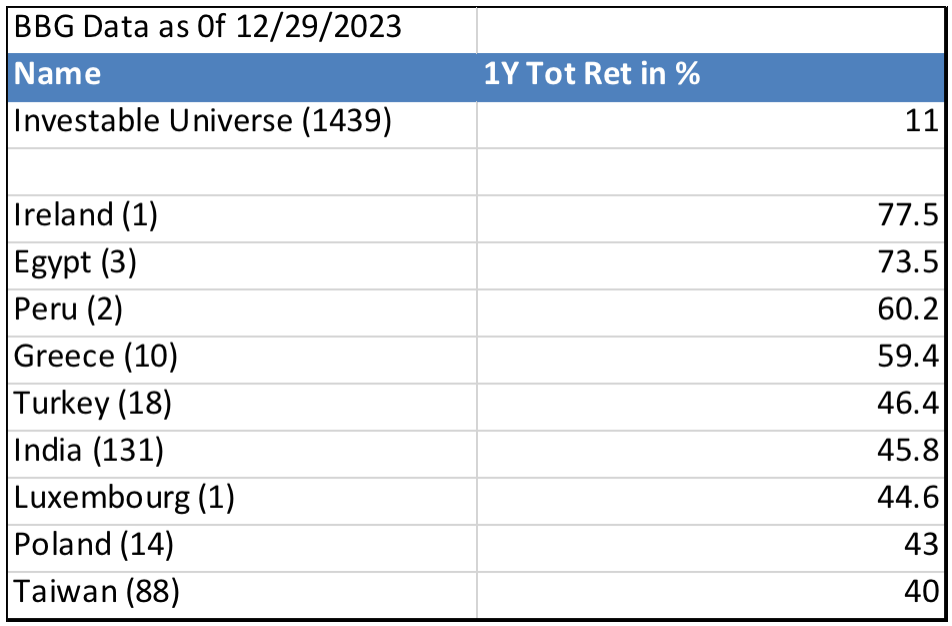

Taiwan was up roughly 40% in the MSCI EM Index in 2023, and the main drivers were the long-term structural belief in the growth of cloud, AI (artificial intelligence), data centers, and everything with a chip, which Taiwan simply dominates. We should have had a bigger position in companies in Taiwan.

Many of the other country winners in the Index were opening trades. We captured a couple of these outperformers through our ownership of Polish and Greek retailers, Dino Polska (DNP PW) and JUMBO (BELA GA). Both benefitted as mobility increased in the region.

And, as you can see from above, the structural story of India (often known symbolically by the Elephant) continued to perform. We believe this is a phenomenal long-term story, and hence India is our largest portfolio weight.

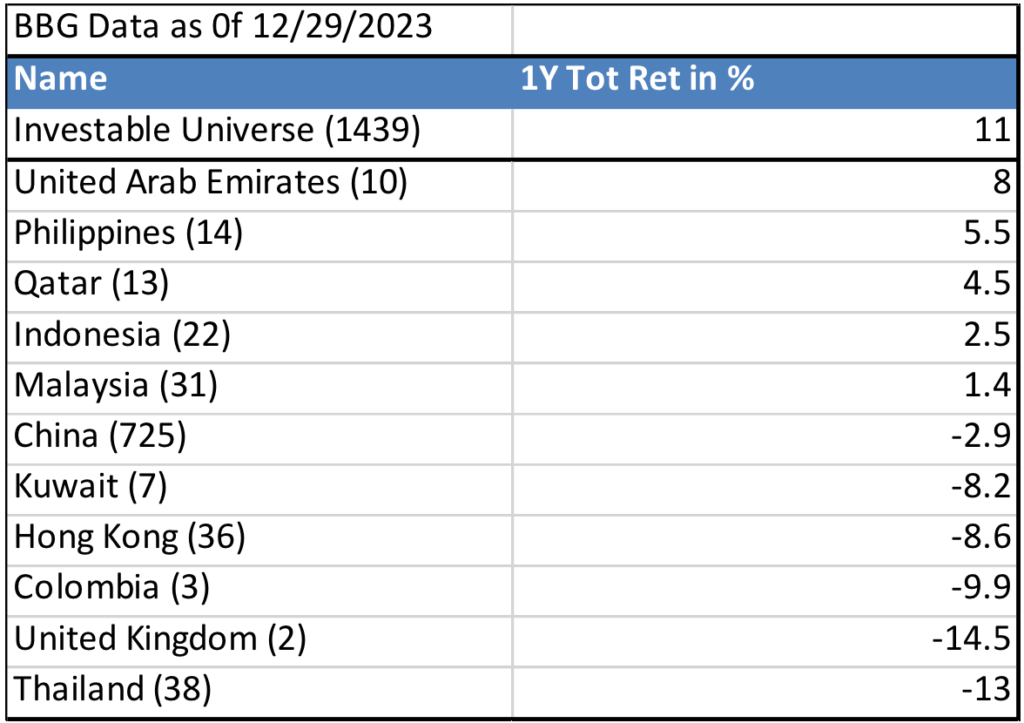

Below are all the countries that underperformed in 2023 in the MSCI EM Index.

Many of these countries (even China) outperformed in 2022 when they came out of lockdown, so outperformance in 2022 saw mean reversion this year. We think this has all recalibrated now, and on the bright side, we saw very few fundamental gaffes from our companies that lead us to believe we have a broken portfolio. What we saw this year was rotation to beaten up spaces and aggregate multiple contraction based on higher interest rates.

China is one of the few markets in the world that is cheap versus its domestic bonds. The earnings yield of stocks is higher than bonds, which is typically a favorable market sign for locals, who can snap up stocks that often have higher dividend yields than they can get at the bank or from a government bond.

Uni-President China Holdings (220 HK), which is a leading instant noodle and beverage maker in China, is trading with a dividend yield that is 2-3x higher than the 10-year bond yield in China. The dividend is cash funded (net cash company) and the company is growing earnings. Yet, no one cares–not even the locals with zero currency risk who should see this as a no brainer fundamental investment. China’s leadership has killed all animal spirits including where internal fundamentals make sense.

We saw this on the ground in September on a trip to China and Hong Kong. Management sentiment had soured, as locals started to worry about a deflationary Japan-style bust for their businesses.

The reality is China is growing, but not as fast as most people expected or as fast as other countries have grown coming out of Covid-19, so not all has been bad—just not as good as desired. Much of what is happening is the government sapping confidence and hence the multiple on stocks out of fear that the fall in growth is around the corner.

As for China, it is starting to become less relevant to the performance of emerging markets in general, and we remain underweight.

October of 2020 was the start of the crackdown on Alibaba amid Covid-19. China and Hong Kong (a China proxy) were over 42% of the MSCI EM Index. As China went, so went emerging markets. In contrast, India was 8.23% of the index at that time.

As of the end of 2023, China and Hong Kong are only about 25% of the index, representing a colossal fall from grace. China is single-handedly minimizing its drag on aggregate index performance.

India, meanwhile, has increased its standing to 16.73% of the index, but more importantly, India, has now created a flywheel for future economic performance through real structural reforms, investment in infrastructure to multiply investment, and now perhaps, the most important factor, it is gaining the trust of global investors that China has lost. A virtuous cycle is unfolding, and it is reasonable to think that India will be the index elephant by the end of this year—if current trends hold. We continue to believe it should be our largest country holding. Yes, it is expensive, but there is nowhere in the world we believe more in the growth.

Plus, if you marry the quality value that is evident in many sectors and countries in emerging markets (Indonesia, Mexico, Brazil, Malaysia, the Philippines, and Poland are examples where we are overweight, and financials are cheap for the quality and growth, and we have been increasing our weight there, too.) to the quality growth in India, you get a great balanced portfolio (bar belled between growth and value) that has a catalyst in a peak dollar (lower rates).

All-in-all we feel good about the quality of our companies and our mix of countries and sectors. We believe we have higher ROE, higher ROA, and better balance sheets than the index. In addition, the premium we are paying for quality is coming with what we project will be faster growth. We are finding many opportunities, and our cash is fully deployed.

Outlook

2024 is the Year of the Dragon in the Chinese Zodiac, but the last few years have been anything but good for China, and hence for EM, which made 2023 a tough year for emerging markets.

What we see now is a valuation gap between EM and developed markets (especially the US) that has never been wider, by some metrics. We think the valuation case for EM is strong on both a relative and absolute basis.

We also see catalysts that could charge emerging markets stocks, including a weakening of the US dollar and peaking US interest rates.

China is certainly cheap, and it would be an even bigger kicker to emerging markets if the government gets serious about stimulus and an open economy.

We still think emerging markets will do well this year, based on valuation, if China does not participate; it is making itself less important to aggregate performance. We believe the decreasing index concentration is great for investors. The index was not diversified when China represented more than 42% at peak.

Why does this matter for active investors? Because we believe you need durable returns broadly to attract more participants. We believe this will lead to more confidence in the countries of emerging markets to make investments. This is what we are seeing in India. We need absolute returns in the asset class and the set up above seems to suggest a macro and micro backdrop supportive of this possibility.

During the opening ceremony of the International Olympic Committee session in Mumbai, Prime Minister Narendra Modi said India was “eager to host” the 2036 Olympics. There is no bigger indicator that your time has come on the global stage than the Olympics (and of course, the actual event is usually a harbinger of a peak): the elephant is emerging to cast a new shadow on the global order. We think this is a big positive for emerging markets—a more diversified index with a new emerging power.

The catalysts are in place for better emerging markets performance. We believe we are positioned to capture performance when it comes.

Thank you for your continued support for Rondure Global Advisors. We appreciate your partnership and trust!

~ The Rondure Team

TOP TEN HOLDINGS | As of October 31, 2023

Rondure New World Fund

| Company | % of Portfolio | COUNTRY | SECTOR |

|---|---|---|---|

| Yum China Holdings, Inc. | 3.2% | China | Consumer Discretionary |

| Bangkok Bank Public Company Limited | 3.1% | Thailand | Financials |

| Hong Kong Exchanges & Clearing Ltd. | 3.0% | Hong Kong | Financials |

| PT Bank Rakyat Indonesia | 2.9% | Indonesia | Financials |

| Heineken Malaysia | 2.5% | Malaysia | Consumer Staples |

| HDFC Bank Ltd. | 2.4% | India | Financials |

| Tata Consultancy Services Ltd. | 2.4% | India | Information Technology |

| ANTA Sports Products Ltd. | 2.4% | China | Consumer Discretionary |

| Sinbon Electronics Co., Ltd. | 2.2% | Taiwan | Information Technology |

| HCL Technologies Ltd. | 2.1% | India | Information Technology |

Holdings are subject to change and do not constitute a recommendation or solicitation to buy or sell a particular security.

FUND PERFORMANCE | As of December 31, 2023

Rondure New World Fund

| QTR | YTD | 1 Year* | 3 Year* | 5 Year* | Since Inception | |

|---|---|---|---|---|---|---|

| INSTITUTIONAL | 1.21% | -2.51% | -2.51% | -4.49% | 4.02% | 2.69% |

| INVESTOR | 1.16% | -2.67% | -2.67% | -4.71% | 3.78% | 2.44% |

| MSCI EMERGING MARKETS TR NET INDEX1 | 7.78% | 9.83% | 9.83% | -5.08% | 3.68% | 3.18% |

The performance data quoted represents past performance. Current performance may be lower or higher than the performance data quoted above. Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than their original cost. For performance information current to the most recent month-end, please call toll-free 1.855.775.3337.

An investor should consider investment objectives, risks, charges, and expenses carefully before investing. Visit www.rondureglobal.com to obtain a Rondure Funds Prospectus, which contain this and other information, or call 1.855.775.3337. Read the prospectus carefully before investing.

Rondure New World Fund (RNWOX/RNWIX) – Inception date of 05/01/2017.

Expense ratios as of prospectus dated 08/31/2023 are:

RNWOX: 1.61% Gross / 1.35% Net, RNWIX: 1.31% Gross / 1.10% Net

Data shows past performance, which is not indicative of future performance. Current performance may be lower or higher than the data quoted. To obtain the most recent performance data available, please visit www.rondureglobal.com. The Advisor may absorb certain Fund expenses, without which total return would have been lower. These expense agreements are in effect through October 20, 2024. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

The Advisor has agreed to waive and/or reimburse fees or expenses of the Rondure New World Fund in order to limit Total Annual Fund Operating Expenses After Fee Waiver/Expense Reimbursement (excluding acquired fund fees and expenses, brokerage expenses, interest expense, taxes and extraordinary expenses) to 1.35% and 1.10% of the Fund’s average daily net assets for the Fund’s Investor Class Shares and Institutional Class Shares, respectively. The limits for the Rondure Overseas Fund are 1.10% for the Investor Share Class and 0.85% for the Institutional Share Class, net of fees. This agreement (“the Expense Agreement”) shall continue at least through October 20, 2024. The Adviser will be permitted to recapture, on a class-by-class basis, expenses it has borne through the Expense Agreement to the extent that the Fund’s expenses in later periods fall below the annual rate set forth in the Expense Agreement or in previous letter agreements; provided, however, that such recapture payments do not cause the Fund’s expense ratio (after recapture) to exceed the lesser of 9i) the expense cap in effect at the time of the waiver and (ii) the expense cap in effect at the time of the recapture. Notwithstanding the foregoing, the Fund will not pay any such deferred fees and expenses more than three years after the date on which the fee and expenses were deferred. The Expense agreement may not be terminated or modified by the Adviser prior to October 20, 2024, except with approval of the Fund’s Board of Trustees.

See the prospectus for additional information regarding Fund expenses. Rondure Funds will deduct a 2.00% redemption proceeds fee on Fund shares held 60 days or less. Performance data does not reflect the deduction of this redemption fee or taxes, which if reflected, would reduce the performance quoted. For more complete information including charges, risks and expenses, read the prospectus carefully.

The objective of all Rondure Funds is long-term growth of capital.

1The MSCI Emerging Markets Total Return USD Index is an unmanaged total return index, reported in U.S. Dollars, based on share prices and reinvested dividends of approximately 1,383 companies from 26 emerging market countries. You cannot invest directly in an index.

Risk Considerations

In addition to the risks generally associated with investing in securities of foreign companies, countries with emerging markets also may have relatively unstable governments, social and legal systems that do not protect shareholders, economies based on only a few industries, and securities markets that trade a small number of issues.

- There is no guarantee that any investment strategy will achieve its objectives, generate profits or avoid losses.

- Investing involves risk, including loss of principal. The value of the fund’s shares, when redeemed, may be worth more or less than their original cost.

- Equity securities, such as common stocks, are subject to market, economic and business risks that may cause their prices to fluctuate.

Rondure Mutual Funds are distributed by Northern Lights Distributors, LLC, Member FINRA/SIPC

Rondure Global Advisors is not affiliated with Northern Lights Distributors, LLC.